Incredible AI Startup Valuations in Context

The OpenAI Diaspora Aggregate Value • Is Tim Cook Tired? • xAI's Big Burn • OpenAI's Stock Pool • 'Star Wars' Steady Hand • iOS 26 Penetration

Here’s a fun exercise: placing the Big AI companies on the list of most valuable companies in the world, using valuation as a proxy for market cap, of course. Assuming they get their $830B round done, OpenAI would come in at #14 just behind JPMorgan Chase ($905B), just ahead of Tencent ($713B). Anthropic, if they get their $375B round done would be #30, just behind LVMH ($377B), just ahead of Home Depot ($373B). xAI (more on them below), at $235B would come in at #72, just behind Royal Bank of Canada ($238B) and just ahead of Thermo Fisher Scientific ($233B). And there’s a sky full of OpenAI “Constellations” out there…

🌌 The Incredible Valuation Heights of the OpenAI “Constellations”

Now past $700B in aggregate. Add in OpenAI itself and we’re at $1.5T.

I Note…

🍎 Is Tim Cook Tired?

This is maybe the biggest takeaway from what is ostensibly a profile of John Ternus, Apple’s next would-be/may be CEO, but doesn’t contain a whole lot that is new. If anything, the piece also sort of frames a case against him in the role, talking to critics who all think he’s a nice guy, but perhaps too "low profile" or too much in the mould of Cook — more a manager, less an innovator. It also points to Cook potentially filling a pipeline of candidates for the board, with all of the obvious names, with the only other one that actually seems viable being Craig Federighi. The story does confirm that Cook would most likely step into the chairman of the board role upon stepping down as CEO. And that’s especially interesting given the news today that the current board chair, Arthur Levinson, is standing for re-election despite the fact that he’s 75 years old — Apple’s longstanding "guideline" for when someone should step down from the board. Apple has issued a statement to shareholders saying they would make an exception for Levinson (and Ron Sugar, who is actually 77) in part because of other recent board turnover. But unstated there, of course, is the Cook situation. Not to mention all of the other recent turnover atop Apple. John Gruber pushes back against the "tired" bit — because who on Earth would leak/talk about that? — and also ties to to the talk of potential health issues with Cook. But he only cites one of the stories about such issues, as I called out a month ago, it was actually buried in two different stories from two different publications! And no one else is talking about this. [NYT]

💸 xAI’s Big Burn

Mounting losses while ramping revenue is more or less the story of every startup, hence the need to raise capital. AI has just kicked it into a gear never seen before, and xAI may actually be burning more money than even OpenAI at this point. That’s obviously, in part, because they have far less revenue. And while that’s growing at a good clip, the story sort of buries the notion that they likely missed their revenue growth goal in 2025 — something it seems like OpenAI sailed past. All of this, plus the incredible data center build-out that xAI is embarking on so obviously points to a world in which xAI merges with Tesla. And that’s previewed in this story too: "The company told investors that its goal is to build AI that is self-sufficient and that will eventually power humanoid robots like Optimus." If the actual car business keeps slipping and a new narrative is needed… Well, it’s right there. Remember when Elon paid $44B for Twitter and then no one ever talked about that deal again because it’s now buried under xAI? He has now raised just about as much money for xAI as he paid for Twitter. A masterful sleight of hand. [Bloomberg 🔒]

🏊 OpenAI’s Stock Pool

Not surprising that alongside the move to give out actual equity, OpenAI would create a pool for new hires. But it’s a sizable one for a company this stage at 10%. It also, assuming The Information’s numbers are correct, pushes the employee equity to 26% of the company (of that, Ilya Sutskever apparently controls a ton by himself). Interestingly, that’s exactly one percent behind Microsoft and perhaps exactly what the non-profit now holds, again, if previous reports are accurate. When you add in SoftBank’s 11%, well, that’s exactly 90% of the company. That leaves just 10% for all the other investors — including NVIDIA, which may be on the verge of buying upwards of 10% as well (albeit over time — also that deal still isn’t finalized). The cap table math is getting pretty complicated and crowded here. It’s enough to make you think OpenAI needs to go public, pronto, to clean it up. So perhaps another of my predictions for 2026 will be incorrect. [Information 🔒]

🤺 The On Time & On Budget Jedi

This profile paints Shawn Levy as the ultimate safe choice for Lucasfilm to make for rebooting their Star Wars cinematic universe (after this year’s Mandalorian movie wraps up a successful Disney+ streaming run). Then again, so was J.J. Abrams back in the day — and it worked well, until it decidedly did not. It is nice that Levy seems to be genuinely giddy about making Starfighter (though we’ve also been down that road before…). And even the emotional bit at the end seemed honest. But there is the weird Kathleen Kennedy overhang here — this will apparently be the last movie she oversaw for Disney. Killer opening though, with Tom Cruise on set manning the camera? Footage that they’ll apparently use in the movie? The last real movie star truly does it all. I’m cautiously optimistic. [NYT]

I Quote…

"Finally updated my iPhone to Liquid Glass. If you’re ever having imposter syndrome, this update is proof that even professionals at billion-dollar companies make huge mistakes."

— Hannah on Threads, via Cult of Mac, which has a story about the low uptake of iOS 26. Not just low, but so historically low by Apple standards that it almost seems like there must be a mistake in the data? I mean, we’re talking just 15% of users, when previous versions saw percentages in the mid-50s to mid-60s by now. Even if you should never trust third-party data, such a trend seemingly can’t lie — again, unless the StatCounter data are bad in some way.

Anecdotally, I will say I know more people who refuse to upgrade to iOS 26 than any previous iOS update. And yes, it’s all because of Liquid Glass. Personally, I don’t mind it — I like some elements, dislike others — but I’m also not the type of person that wouldn’t upgrade to any new OS on day one. Regardless, Apple has a built in fall guy here, as he no longer works at Apple.

Asides…

Paramount decides to stand firm at $30/share and will take it to the WBD shareholders on January 21. That may come down to what happens to Versant’s share price between now and then — it was up today for the first time. [THR]

My bet would still be that they up the bid a bit to try to push both shareholders and the board over the edge… [Reuters]

Shocker: the movie theater lobby is against the deal. Any deal. No matter who wins. They prefer the slow death sequence. [THR]

NVIDIA hires their first CMO, from Google, which seems like something you only do if you’re about to do a lot more marketing… [WSJ 🔒]

Another show to skewer Silicon Valley, though The Audacity from AMC sounds decidedly darker. This one also has Succession ties, though not as directly as Jesse Armstrong’s Mountainhead, which was misguided and entirely forgettable. Can they just bring back Halt & Catch Fire please? [TechCrunch]

Another day, another confidential IPO filing, with Strava following closely behind Discord’s draft. Small revenue, but good growth. [Information 🔒]

I Spy…

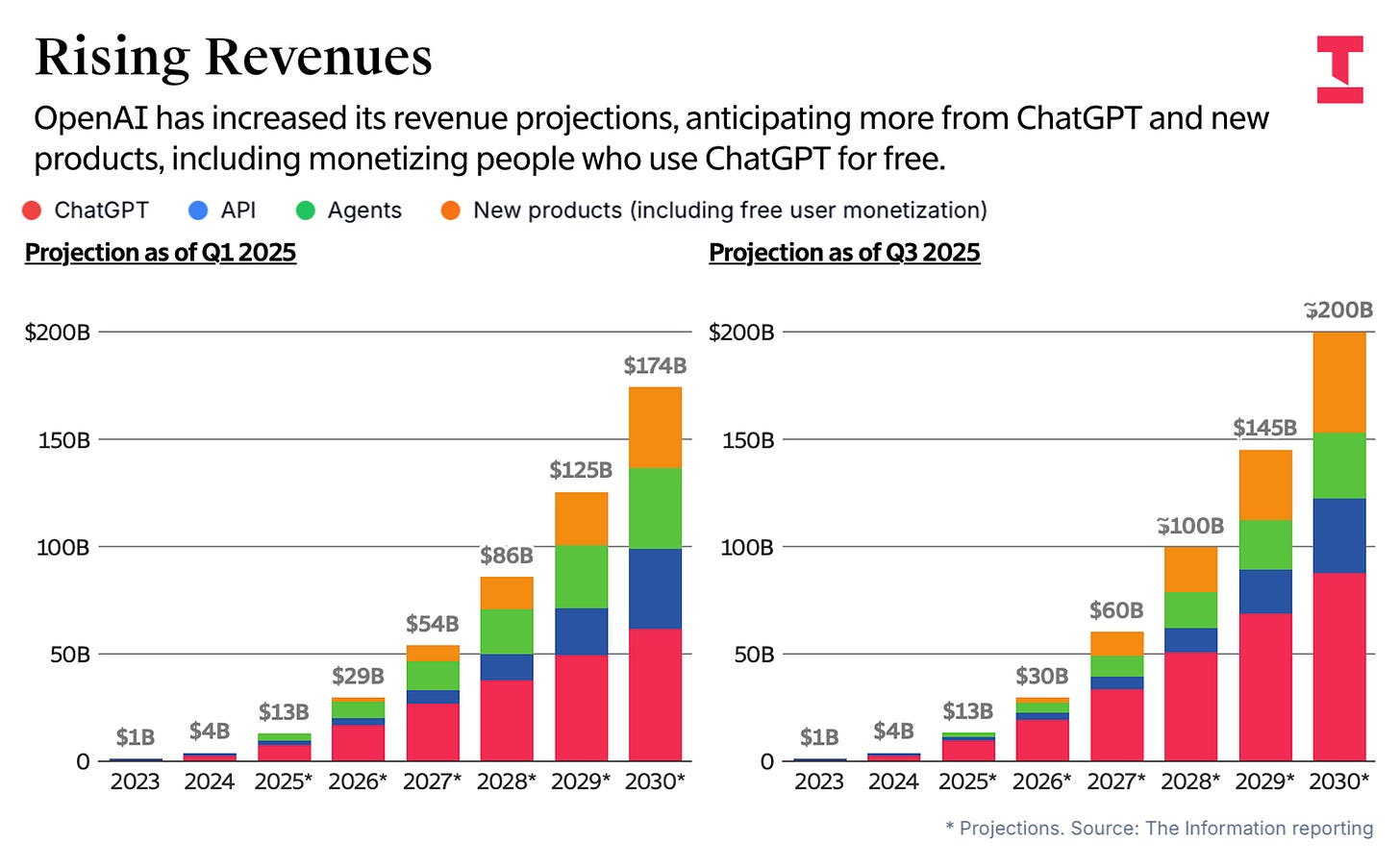

On the topic of OpenAI beating their revenue growth projections…